第一題:

Meura Bancorp, a US bank, has an equity capital ratio for financial assets of 12%. Meura’s strategic plans include the incorporation of additional debt in order to leverage earnings since the current capital structure is relatively conservative. The bank plans to restructure the balance sheet so that the equity capitalization ratio drops to 10% and the modified duration of liabilities is 1.90. The bank also plans to rebalance its investment portfolio to achieve a modified duration of assets of 2.10. Given small changes in interest rates, the yield on liabilities is expected to move by 65 bps for every 100 bps of yield change in the asset portfolio.

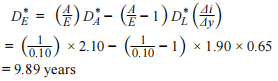

Calculate the modified duration of the bank’s equity capital after restructuring. Show your calculations.

A Asset class preferences

B Other investment preferences

C Constraints

解析:

The modified duration of the bank’s equity capital after restructuring is 9.89 years:

第二題:

Which proposed allocation in Exhibit 1 would be most appropriate for the Fund given its characteristics?

A Allocation 1

B Allocation 2

C Allocation 3

解析:

C is correct. Allocation 3 is the most appropriate allocation for the Fund. The annual expected returns for the three allocations are as follows:

Allocation 1 exp. return = (0.45 × 4.1%) + (0.40 × 6.3%) + (0.10 × 7.5%) + (0.05 × 9.1%)

= 5.57%.

Allocation 2 exp. return = (0.10 × 4.1%) + (0.15 × 6.3%) + (0.15 × 7.5%) + (0.30 × 5.0%) + (0.30 × 9.1%)

= 6.71%.

Allocation 3 exp. return = (0.13 × 4.1%) + (0.32 × 6.3%) + (0.40 × 7.5%) + (0.05 × 5.0%) + (0.10 × 9.1%)

= 6.71%.

The real return for Allocation 1 is 3.07% (= 5.57% – 2.50%), and the real return for Allocation 2 and Allocation 3 is 4.21% (= 6.71% – 2.50%).

Therefore, Allocation 1 is not appropriate because the expected real rate of return is less than the annual spending rate of 4%. With expected spending at 4%, the purchasing power of the Fund would be expected to decline over time with Allocation 1.

Allocations 2 and 3 both offer an expected real rate of return greater than the annual spending rate of 4%. Thus, the purchasing power of the Fund would be expected to grow over time with either allocation. However, Allocation 3 is more appropriate than Allocation 2 because of its lower allocation to alternative assets (hedge funds and private equity). The total 60% allocation to alternative assets in Allocation 2 is well above the 15% allocation in Allocation 3 and is likely too high considering the Fund’s small investment staff and its limited experience with managing alternative investments. Also, given the Fund’s relatively small size of assets under management ($200 million), access to top hedge funds and private equity managers is likely to be limited.

閱讀排行

-

1

CFA持證要求申請流程詳解

-

2

2026年CFA協(xié)會官方備考資源指南

-

3

2026年CFA考試報名考試時間!

-

4

2025年全國應(yīng)屆生薪資榜發(fā)布丨普通院校“超車道”的機會在哪里?

-

5

CFA考試對英文水平有要求嗎?CFA考試科目有哪些?

-

6

融躍教育推出CFA考試通關(guān)10件套,助力考生高效備戰(zhàn)2026!

-

7

2026年CFA考試報名條件和費用,費用有重大調(diào)整!

-

8

2026年CFA考試早鳥階段報名開始,立省350美元!

-

9

融躍教育CFA定制1V1私教服務(wù):您的專屬通關(guān)規(guī)劃師 !

-

10

特許金融分析師(CFA)考試各等級備考時長全解析